We Are Active Owners

Kinnevik has influence over our investee companies through capital allocation, Board representation and ongoing operational support. We work in close collaboration with our companies in setting bold strategic visions and targets for building long-term sustainable and successful businesses. To structure and follow up on this work, we have developed a proprietary ESG assessment framework - the Kinnevik Standards.

An Integral Part of Our Value Creation

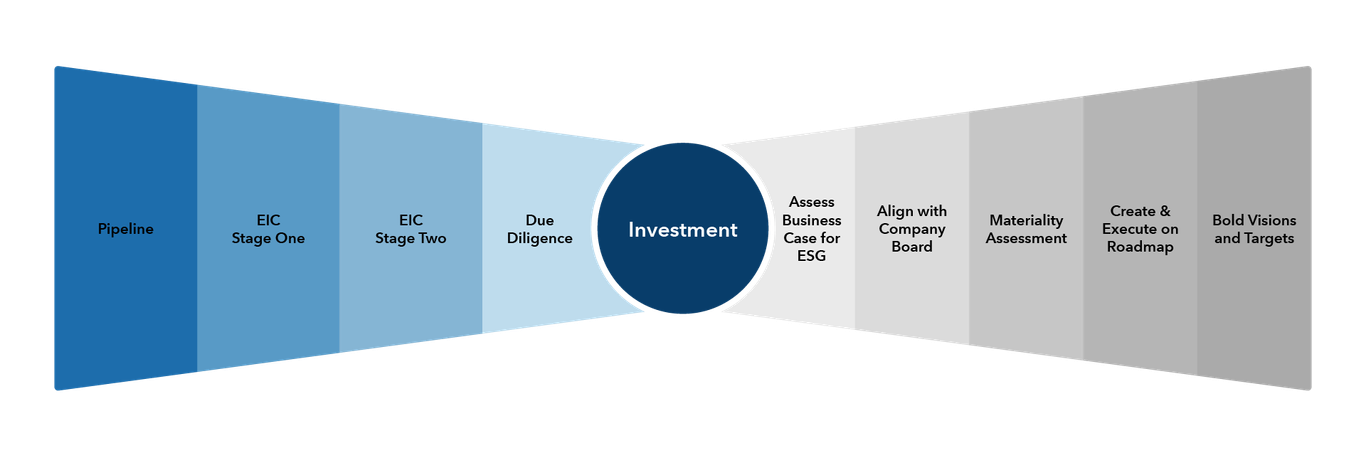

Kinnevik’s sustainability team is represented at each stage of the investment process, and only companies that fit our investment ethos and share our values are brought to the Executive Investment Committee (”EIC”). In connection with the EIC, we assess a company’s sustainability structures and progress across environmental, social and governance aspects, its positive and negative impacts in accordance with the Impact Management Norms, its sustainability risks and opportunities, and its alignment with a low-carbon future.

After investment, we have a structured and bespoke approach to sustainability. We support the companies with a double materiality analysis to identify their key sustainability topics, to align priorities internally and to determine how sustainability can add business value. As appropriate, we also help articulate and measure their positive impact on the world. This lays the foundation for a holistic sustainability strategy including visions, targets and a concrete roadmap.

The Kinnevik Standards

To measure performance and define best practices for our companies, Kinnevik has developed a proprietary ESG assessment framework called the Kinnevik Standards (the “Standards”). These were developed based on stakeholder dialogues, peer benchmarking and industry best practice and comprise 84 measurement points across environmental, social and governance aspects.

Kinnevik conducts an annual assessment of our portfolio companies in accordance with the Standards and, based on the outcome, agrees priorities and annual objectives for each company, including in relation to supply chain risks and compliance.

The 2023 assessment included 34 companies, three public and 31 private, corresponding to just under 100 percent of Kinnevik’s portfolio value as of 31 December 2023. On a comparative basis, the average 2023 ESG score across our portfolio increased by 10 percentage points, from 51 percent in 2022 to 61 percent in 2023.

Overview of Kinnevik’s investment process and post-investment ESG engagement with our companies